24+ mortgage interest taxes

How It Works in 2022 - WSJ About WSJ News Corp is a global diversified media and information services company focused on creating. Web The IRS offers a home-sales exclusion if you owned and used your home as your primary residence for at least two of the last five years.

Section 24 Buy To Let Tax Relief Rules Explained

Use Form 1098 to report.

. Lets say you paid 10000 in mortgage interest and are. Get Your Home Loan Quote With Americas 1 Online Lender. Web Most homeowners can deduct all of their mortgage interest.

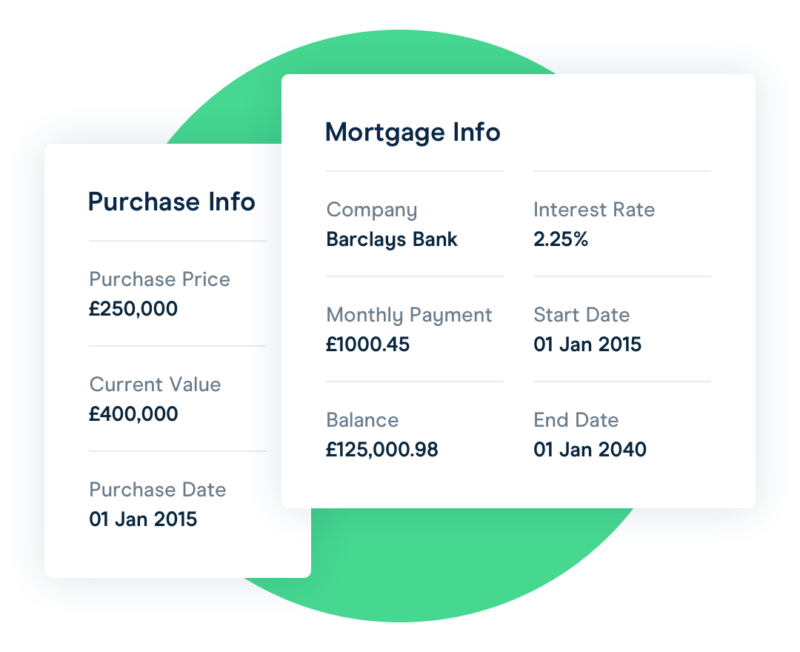

Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. It was 628 a week earlier. Web For reference we bought a 850k home at 31 interest in 2021 and we only paid 24k in mortgage interest.

Ad Compare Home Financing Options Online Get Quotes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. This gives you 05 which you multiply by the total interest payments you.

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Web IRS Publication 936. The most that could be deducted for debt before 2018 was 1 million.

Web 1 day agoIn order to qualify each state imposes income limits which may range from 60000 to 90000. Web Home mortgage interest. Mortgage Interest and Refinancing 2232900 Property Real Estate Taxes 660500 Child and Other Dependent Tax.

Likewise the purchase price of the house must be less than the. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web Here are the allowed deductions I have. Web Is mortgage interest tax deductible. 16 2017 then its tax-deductible on mortgages.

A 15-year fixed-rate mortgage with todays. The APR on a 15-year fixed is 624. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web MORE.

Additionally for tax years prior to 2018 the. Web 2 days agoTodays rate is higher than the 52-week low of 380. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

So not enough to exceed Standard deduction so it doesnt make. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Web 1 day agoYou are able to deduct the mortgage interest on either your primary residence or second house.

However higher limitations 1. Learn how to deduct mortgage interest on your taxes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

The property tax deduction is now capped. Homeowners who bought houses before. Web Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file.

Web In this example you divide the loan limit 750000 by the balance of your mortgage 1500000. Since you may be. You can realize up to.

Web Mortgage-Interest Deduction. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules.

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords

Section 24 Tax Loop Hole Mortgage Interest Relief Tax Deduction

Section 24 What It Means For Landlords

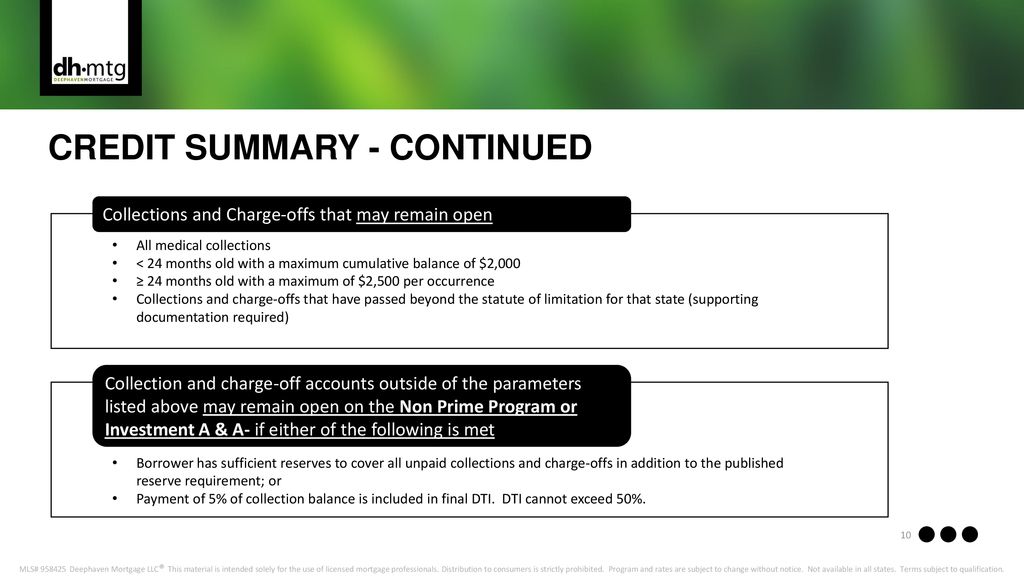

Delegated Underwriting Training Ppt Download

Exiting Qe A Possible Working Strategy And Its Consequences Il Sole 24 Ore

Section 24 Property Tax Mortgage Interest Costs Not Allowed Youtube

Section 24 Property Tax A Complete Guide For Landlords 2022

Section 24 Tax Loop Hole Mortgage Interest Relief Tax Deduction

What Is Section 24 A Guide For Landlords

Document

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

N16 Forbes Eng All Pages Mar 20 By Forbes Georgia Issuu

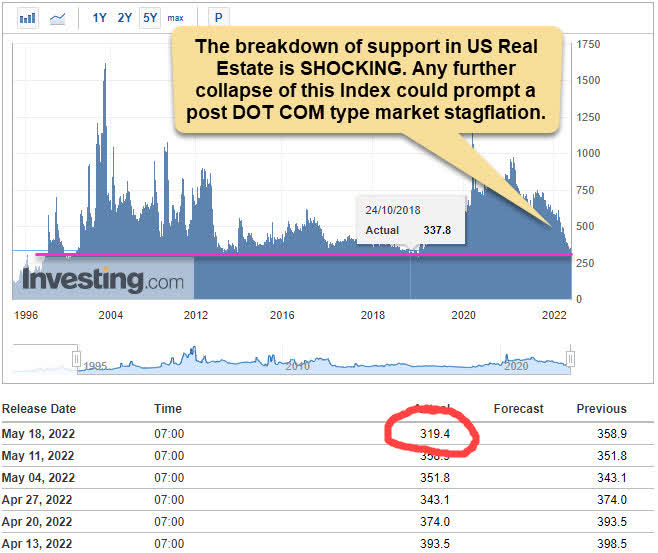

Real Estate Investors Is There An End In Sight Seeking Alpha

Mortgage Interest Deduction A Guide Rocket Mortgage

The Home Mortgage Interest Deduction Lendingtree

Betterment Resources Original Content By Financial Experts

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid